A Research Design Used by a Marketing Researcher

Today's consumers have a lot of power. They can research your product or service and make purchase decisions entirely on their own. Moreover, rather than talking to one of your sales reps, they're more likely to ask for referrals from members of their networks or read online reviews. With this in mind, have you adapted your marketing strategy to complement the way today's consumers research, shop, and buy? To do just that, you must have a deep understanding of who your buyers are, your specific market, and what influences the purchase decisions and behavior of your target audience members. Enter: Market Research. Whether you're new to market research, this guide will provide you with a blueprint for conducting a thorough study of your market, target audience, competition, and more. Market research is the process of gathering information about your business's buyers personas, target audience, and customers to determine how viable and successful your product or service would be, and/or is, among these people. Market research allows you to meet your buyer where they are. As our world (both digital and analog) becomes louder and demands more and more of our attention, this proves invaluable. By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them. Market research also provides insight into a wide variety of things that impact your bottom line including: As you begin honing in on your market research, you'll likely hear about primary and secondary market research. The easiest way to think about primary and secondary research is to envision to umbrellas sitting beneath market research: one for primary market research and one for secondary market research. Beneath these two umbrellas sits a number of different types of market research, which we'll highlight below. Defining which of the two umbrellas your market research fits beneath isn't necessarily crucial, although some marketers prefer to make the distinction. So, in case you encounter a marketer who wants to define your types of market research as primary or secondary — or if you're one of them — let's cover the definitions of the two categories next. Then, we'll look at the different types of market research in the following section. There are two main types of market research that your business can conduct to collect actionable information on your products including primary research and secondary research. Primary research is the pursuit of first-hand information about your market and the customers within your market. It's useful when segmenting your market and establishing your buyer personas. Primary market research tends to fall into one of two buckets: exploratory and specific research. This kind of primary market research is less concerned with measurable customer trends and more about potential problems that would be worth tackling as a team. It normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people. Specific primary market research often follows exploratory research and is used to dive into issues or opportunities the business has already identified as important. In specific research, the business can take a smaller or more precise segment of their audience and ask questions aimed at solving a suspected problem. Secondary research is all the data and public records you have at your disposal to draw conclusions from(e.g. trend reports, market statistics, industry content, and sales data you already have on your business). Secondary research is particularly useful for analyzing your competitors. The main buckets your secondary market research will fall into include: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — lots of bang for your buck here. Government statistics are one of the most common types of public sources according to Entrepreneur. Two U.S. examples of public market data are the U.S. Census Bureau and the Bureau of Labor & Statistics, both of which offer helpful information on the state of various industries nationwide. These sources often come in the form of market reports, consisting of industry insight compiled by a research agency like Pew, Gartner, or Forrester. Because this info is so portable and distributable, it typically costs money to download and obtain. Internal sources deserve more credit for supporting market research than they generally get. Why? This is the market data your organization already has! Average revenue per sale, customer retention rates, and other historical data on the health of old and new accounts can all help you draw conclusions on what your buyers might want right now. Now that we've covered these overarching market research categories, let's get more specific and look at the various types of market research you might choose to conduct. Interviews allow for face-to-face discussions (in-person and virtual) so you can allow for a natural flow or conversation and watch your interviewee's body language while doing so. Focus groups provide you with a handful of carefully-selected people that you can have test out your product, watch a demo, provide feedback, and/or answer specific questions. Product or service use research offers insight into how and why your audience uses your product or service, and specific features of that item. This type of market research also gives you an idea of the product or service's usability for your target audience. Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX, what roadblocks they hit, and which aspects of it could be easier for them to use and apply. Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, what they need from your business and brand, and more. Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics — this way, you can determine effective ways to meet their needs, understand their pain points and expectations, learn about their goals, and more. Pricing research gives you an idea of what similar products or services in your market sell for, what your target audience expects to pay — and is willing to pay — for whatever it is you sell, and what's a fair price for you to list your product or service at. All of this information will help you define your pricing strategy. Competitive analyses are valuable because they give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry, what your target audience is already going for in terms of products like yours, which of your competitors should you work to keep up with and surpass, and how you can clearly separate yourself from the competition. Customer satisfaction and loyalty research give you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g. loyalty programs, rewards, remarkable customer service). This research will help you discover the most-effective ways to promote delight among your customers. Brand awareness research tells you about what your target audience knows about and recognizes from your brand. It tells you about the associations your audience members make when they think about your business and what they believe you're all about. Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. It requires experimentation and then a deep dive into what reached and resonated with your audience so you can keep those elements in mind for your future campaigns and hone in on the aspects of what you do that matters most to those people. Now that you know about the categories and types of market research, let's review how you can conduct your market research. Here's how to do market research step-by-step. Before you dive into how customers in your industry make buying decisions, you must first understand who they are. This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers. Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better. They help you visualize your audience, streamline your communications, and inform your strategy. Some key characteristics you should be keen on including in your buyer persona are: The idea is to use your persona as a guideline for how to effectively reach and learn about the real audience members in your industry. Also, you may find that your business lends itself to more than one persona — that's fine! You just need to be thoughtful about each specific persona when you're optimizing and planning your content and campaigns. To get started with creating your personas, check out these free templates, as well as this helpful tool. Now that you know who your buyer personas are, use that information to help you identify a group to engage to conduct your market research with — this should be a representative sample of your target customers so you can better understand their actual characteristics, challenges, and buying habits. The group you identify to engage should also be made of people who recently made a purchase or purposefully decided not to make one. Here are some more guidelines and tips to help you get the right participants for your research. When choosing who to engage for your market research, start by focusing on people who have the characteristics that apply to your buyer persona. You should also: Aim for 10 participants per buyer persona. We recommend focusing on one persona, but if you feel it's necessary to research multiple personas, be sure to recruit a separate sample group for each one. You may want to focus on people that have completed an evaluation within the past six months — or up to a year if you have a longer sales cycle or niche market. You'll be asking very detailed questions so it's important that their experience is fresh. You want to recruit people who have purchased your product, purchased a competitor's product, and decided not to purchase anything at all. While your customers will be the easiest to find and recruit, sourcing information from those who aren't customers (yet!) will help you develop a balanced view of your market. Here are some more details on how to select this mix of participants: The best way to make sure you get the most out of your conversations is to be prepared. You should always create a discussion guide — whether it's for a focus group, online survey, or a phone interview — to make sure you cover all of the top-of-mind questions and use your time wisely. (Note: This is not intended to be a script. The discussions should be natural and conversational, so we encourage you to go out of order or probe into certain areas as you see fit.) Your discussion guide should be in an outline format, with a time allotment and open-ended questions for each section. Wait, all open-ended questions? Yes — this is a golden rule of market research. You never want to "lead the witness" by asking yes and no questions, as that puts you at risk of unintentionally swaying their thoughts by leading with your own hypothesis. Asking open-ended questions also helps you avoid one-word answers (which aren't very helpful for you). Here's a general outline for a 30-minute survey for one B2B buyer. You can use these as talking points for an in-person interview, or as questions posed on a digital form to administer as a survey to your target customers. Ask the buyer to give you a little background information (their title, how long they've been with the company, and so on). Then, ask a fun/easy question to warm things up (first concert attended, favorite restaurant in town, last vacation, etc.). Remember, you want to get to know your buyers in pretty specific ways. You might be able to capture basic information such as age, location, and job title from your contact list, there are some personal and professional challenges you can really only learn by asking. Here are some other key background questions to ask your target audience: Now, make a transition to acknowledge the specific purchase or interaction they made that led to you including them in the study. The next three stages of the buyer's journey will focus specifically on that purchase. Here, you want to understand how they first realized they had a problem that needed to be solved without getting into whether or not they knew about your brand yet. Now you want to get very specific about how and where the buyer researched potential solutions. Plan to interject to ask for more details. If they don't come up organically, ask about search engines, websites visited, people consulted, and so on. Probe, as appropriate, with some of the following questions: Here, you want to wrap up and understand what could have been better for the buyer. List your primary competitors — keep in mind listing the competition isn't always as simple as Company X versus Company Y. Sometimes, a division of a company might compete with your main product or service, even though that company's brand might put more effort in another area. For example. Apple is known for its laptops and mobile devices but Apple Music competes with Spotify over its music streaming service. From a content standpoint, you might compete with a blog, YouTube channel, or similar publication for inbound website visitors — even though their products don't overlap with yours at all. And a toothpaste company might compete with magazines like Health.com or Prevention on certain blog topics related to health and hygiene even though the magazines don't actually sell oral care products. To identify competitors whose products or services overlap with yours, determine which industry or industries you're pursuing. Start high-level, using terms like education, construction, media & entertainment, food service, healthcare, retail, financial services, telecommunications, and agriculture. The list goes on, but find an industry term that you identify with, and use it to create a list of companies that also belong to this industry. You can build your list the following ways: Search engines are your best friends in this area of secondary market research. To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with. A catering business, for example, might generally be a "food service" company, but also consider itself a vendor in "event catering," "cake catering," "baked goods," and more. Once you have this list, do the following: After a series of similar Google searches for the industry terms you identify with, look for repetition in the website domains that have come up. Examine the first two or three results pages for each search you conducted. These websites are clearly respected for the content they create in your industry, and should be watched carefully as you build your own library of videos, reports, web pages, and blog posts. Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items. To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips. Feel free to add your own flair, but the following outline should help you craft a clear summary: Lastly, let's review a resource that can help you compile everything we just discussed in a simple yet effective way (plus, it's free!). Within a market research kit, there are a number of critical pieces of information for your business's success. Let's take a look at what those different kit elements are next. Pro Tip: Upon downloading HubSpot's free Market Research Kit, you'll receive editable templates for each of the given parts of the kit as well as instructions on how to use the templates and kit, and a mock presentation that you can edit and customize. Download HubSpot's free, editable market research report template here. Use Porter's Five Forces Model to understand an industry by analyzing five different criteria and how high the power, threat, or rivalry in each area is — here are the five criteria: Download a free, editable Five Forces Analysis template here. A SWOT analysis highlights direct areas of opportunity your company can continue, build, focus on, and work to overcome. Both market surveys and focus groups (which we'll cover in the next section) help you uncover important information about your buyer personas, target audience, current customers, market, competition, and more (e.g. demand for your product or service, potential pricing, impressions of your branding, etc.). Surveys should contain a variety of question types, like multiple choice, rankings, and open-ended responses. Ask quantitative and short-answer questions to save you time and to more easily draw conclusions. (Save longer questions that will warrant more detailed responses for your focus groups.) Here are some categories of questions you should ask via survey: Focus groups are an opportunity to collect in-depth, qualitative data from your real customers or members of your target audience. You should ask your focus group participants open-ended questions. While doing so, keep these tips top of mind: Conducting market research can be a very eye-opening experience. Even if you think you know your buyers pretty well, completing the study will likely uncover new channels and messaging tips to help improve your interactions. Editor's note: This post was originally published in March 2016 and has been updated for comprehensiveness. ![→ Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

What is Market Research?

Primary vs. Secondary Research

Types of Market Research

How To Do Market Research

Market Research Report Template

What is market research?

Why do market research?

Primary vs. Secondary Research

Primary Research

Exploratory Primary Research

Specific Primary Research

Secondary Research

Public Sources

Commercial Sources

Internal Sources

Types of Market Research

1. Interviews

2. Focus Groups

3. Product/Service Use Research

4. Observation-Based Research

5. Buyer Persona Research

6. Market Segmentation Research

7. Pricing Research

8. Competitive Analysis

9. Customer Satisfaction and Loyalty Research

10. Brand Awareness Research

11. Campaign Research

How to Do Market Research

1. Define your buyer persona.

2. Identify a persona group to engage.

How to Identify the Right People to Engage for Market Research

Select people who have recently interacted with you.

Gather a mix of participants.

3. Prepare research questions for your market research participants.

Example Outline of a 30-Minute Survey

Background Information (5 Minutes)

Awareness (5 Minutes)

Consideration (10 Minutes)

Decision (10 Minutes)

Closing

4. List your primary competitors.

Identifying Industry Competitors

Identifying Content Competitors

5. Summarize your findings.

Market Research Report Template

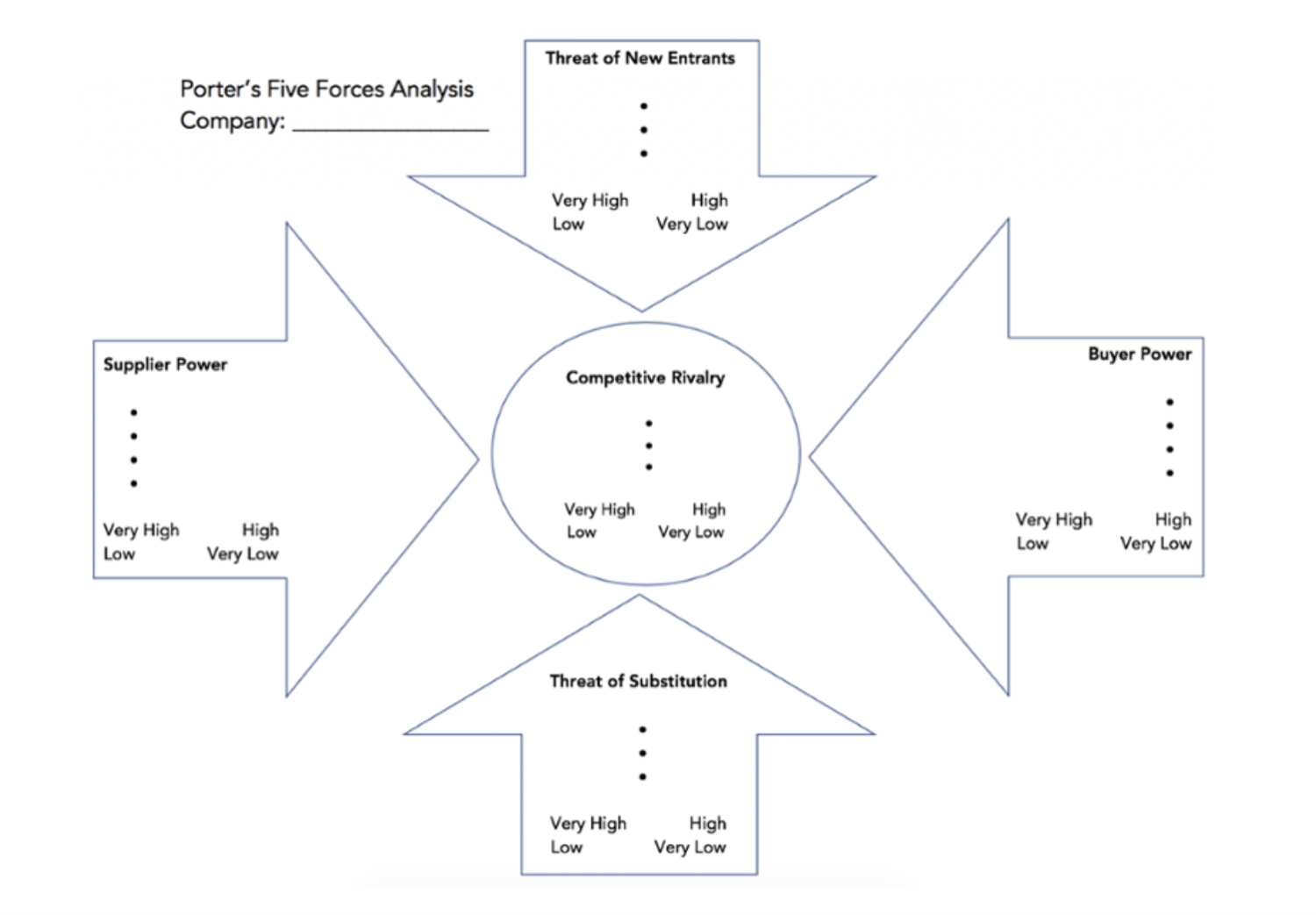

1. Five Forces Analysis Template

2. SWOT Analysis Template

3. Market Survey Template

4. Focus Group Template

Conduct Market Research to Grow Better

Originally published Jan 27, 2021 7:00:00 AM, updated April 27 2021

A Research Design Used by a Marketing Researcher

Source: https://blog.hubspot.com/marketing/market-research-buyers-journey-guide

0 Response to "A Research Design Used by a Marketing Researcher"

Post a Comment